1. Série

Rory a Lorelai nikdy nebudou mít normální vztah "matka a dcera". Oni jsou totiž nejlepší kamarádky. ![]()

Gilmorova děvčata

Lorelai a Rory

Školačka Rory

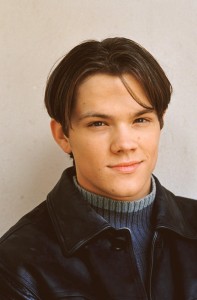

První láska Dea n

n

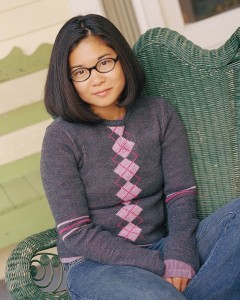

Roryina nejlepší kámarádka Lane

Nejlepší kamarádka Lorelai: Sookie

Matka a otec od Lorelai

Emily Gilmorová

Gilmorová

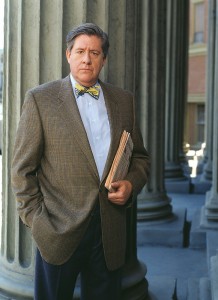

Richard Gilmor

Společné fotky

Komentáře

Přehled komentářů

https://nyedanskecasinoer.com/

Клининг Двухкомнатной Квартиры

(Randallgab, 2. 10. 2025 0:23)Очистка в Северной столицы! Жилые помещения, Дома, Офисы. Опытный клининг по бюджетным расценкам. Свободное время для хобби! Закажите клининг сию минуту! Тапайте https://uborka-top24.ru - Клининговая Компания По Уборке Квартир

Южный Парк онлайн

(RaminDiteta, 19. 9. 2025 8:41)

Всем привет!

Меня зовут Осип и я обожаю смотреть онлайн мультсериал Южный Парк на сайте https://southpark-online.info

Там много интересных серий, которые Вам понравятся.

Присоединяйтесь!

Купить ШИШКИ ГАШИШ СТАФФ КАННАБИС МАРИХУАННА в БАТУМИ

(Blpalalp, 20. 8. 2025 19:45)

В нашем магазине вы найдете товары высочайшего качества для хорошего настроения в БАТУМИ!

*-* ШИШКИ – 31% ТГК

*-* ГАШИШ – 60% ТГК

*-* Низкие цены.

*-* Тайники и магниты.

*-* Моментальная выдача адресов.

*-* Безопасные и безлюдные места в черте города.

*-* №1 Магазин Автопродаж в Батуми.

У нас лучший товар, который вы когда-либо пробовали!

Убедитесь в этом сами, останетесь довольны!

Купить в Телеграмм по ссылке:

https://telegra.ph/AutoShop-1-08-16

или

https://t.me/Link420_Shop

Сервис HR BLACKSPRUT

(MerleMed, 1. 5. 2025 5:33)

«Антискам» – это сервис в рамках проекта «BLACKSPRUT Control», направленный на борьбу с мошенничеством со стороны дилеров. Цель работы – выявление продаж пустых адресов и скама в деятельности магазинов или отдельных сотрудников, чаще всего — курьеров. Сервис «Антискам» нацелен на регулярный мониторинг и проведение проверок для выявления и ликвидации скамеров и мошенников на площадке.

---

https://bsme.quest/bs2site/bs2site-at-products.html

SEARCHING FOR LOST BITCOIN WALLETS

(Lamaalalp, 3. 2. 2024 18:47)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(Lamaalalp, 3. 2. 2024 17:17)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(Lamaalalp, 3. 2. 2024 10:12)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(Lamaalalp, 3. 2. 2024 4:11)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

(Lamaalalp, 2. 2. 2024 22:18)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(Lamaalalp, 2. 2. 2024 18:36)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(Lamaalalp, 2. 2. 2024 16:35)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

(Lamaalalp, 2. 2. 2024 14:46)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

(Lamaalalp, 2. 2. 2024 13:46)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(Lamaalalp, 2. 2. 2024 10:01)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

(Lamaalalp, 2. 2. 2024 8:28)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Bitcoin Exchange

(RogerKit, 2. 2. 2024 3:47)

Haló! Jsme rádi, že vám můžeme sdělit dobré zprávy!

Zveme Vás na soukromou burzu kryptoměn www.cexasia.pro

Čekají na vás jedinečné podmínky pro úspěšné obchodování s námi

Pro první registraci na naší burze vám poskytujeme jedinečný propagační kód "pbasia24" od 100USDT a 30% první vklad!

Vítejte a šťastné nabízení! ]

BITCOIN LOTTERY - SOFTWARE FREE

(Lamaalalp, 2. 2. 2024 2:28)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

(Lamaalalp, 1. 2. 2024 19:40)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56 | 57 | 58 | 59 | 60 | 61 | 62 | 63 | 64

Test

(1go casino, 5. 10. 2025 7:09)